3 Simple Little Daily

Expenses That Can Cut A Huge Hole In Your Finances

This

morning, did you have a Venti Java Chip Frappuccino with an extra shot of

espresso? Or did you opt for a lunch out during your workday instead of the

branded jug of indulgence? The figures don't lie, no matter how little one of

your everyday expenses appears to be. Every dollar you spent on a non-essential

item increased your net worth — possibly more than you realize. Cutting modest

spending is typically pushed as a popular approach to improve your money, but a

closer look at how purchases build up over time illustrates why.

The Latte Factor was introduced to the personal financial industry by David Bach, author of The Automatic Millionaire, more than a decade ago, but it remains pertinent in understanding the power of saves and compounded returns. This common piece of financial advice focuses on cutting costs today in order to have a better tomorrow.

Remember that money is only necessary if you don't die tomorrow.

According to Bach's website, "The Latte Factor is built on the simple premise that all you need to finish rich is to look at the minor things you spend your money on every day and see whether you could redirect that expenditure to yourself."

"Putting aside even a few dollars a day for your future rather than squandering it on small expenditures like lattes, bottled water, fast food, cigarettes, magazines, and so on can make all the difference between generating money and living paycheck to paycheck."

Let's use The Latte Factor Calculator to see how much three commonplace things wind up costing you.

1. Cappuccinos

The

Latte Factor isn't only for your morning caffeine fix, but it's a fantastic

place to start.

If you spend $5 per day on your sugar and caffeine addiction, it will cost you $1,825 each year. If you put that money into an investment with a 5% annual interest rate, you'd have $1,916.25 in your account after only one year. By investing $5 per day on your future self instead on lattes, you might raise your wealth to $127,313.44 over 30 years assuming the same rate of return.

Of course, your money's returns might fluctuate widely year to year and aren't guaranteed, but the goal is to understand how compounded returns can make tiny changes in expenditure add up to a lot over time. Since 1926, equities have returned an average annual return of 6.7 percent after inflation. Starbucks stock has more than doubled in value over the last five years, ironically.

2. Going Out To Eat

Restaurant

visits are essentially a national hobby in the United States. We have a strong

desire to consume food. We are big fans of convenience. It's only natural that

we enjoy eating food that we don't have to prepare ourselves.

According to a Visa poll, Americans have lunch roughly twice a week on average and spend $10 per visit. Worse, those earning less than $25,000 per year spent $11.70 per outing, the highest of any income group.

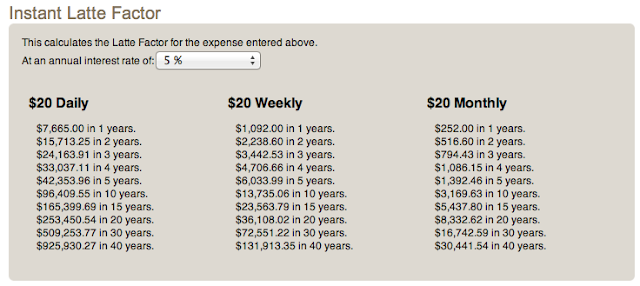

How much does overeating set you back? If you put $20 of your weekly dining-out spending into investments that produce 5% yearly, you could have $13,735.06 in ten years, $36,108.02 in twenty years, or $72,551.22 in thirty years.

Even if you rarely eat out, there's a good chance you can save money on groceries.

According

to a recent TNS Global survey, 76 percent of American homes toss away leftovers

at least once a month, with 53 percent wasting food every week. In fact, just

over half of those polled admit to tossing away food they purchased but never

used.

3. Television stations

While

eating at our favorite trough keeps us occupied for a few minutes, nothing

beats watching television to fill our time.

According to the Department of Labor, Americans watch about three hours of television per day on average, accounting for more than half of our leisure time.

We spend a lot of money for these services.

Since

1995, the average cost of expanded basic cable has risen 6.1 percent each year,

while the average DirectTV payment is $107. According to the NPD Group,

television bills could reach $200 by 2022.

According to Nielsen, the average American household now receives 189 television channels, a new high from 129 in 2008. The majority of the channels are garbage, but you may rearrange your financial future by downgrading your membership or seeking out alternatives such as Netflix. A simple phone call to your company's retention department can sometimes result in cost savings.

If you save $20 every month on your bill, you'll have $5,437.80 in 15 years if you invest at a 5% annual rate. You may have $8,332.62 in 20 years.

Take care of these three little things and watch your wealth grow in leaps and bounds

#wealthisearned

Join our NEWSLETTER and be the first to get a notification whenever we create a new post and also access my TOP 6 LEGITIMATE WAYS TO MAKE MONEY ONLINE

About the Blog

Wealth Is Earned Blog is

owned by Topitup Media And Communication Nigeria whose Team Head is Dr. Jerry -

the First Oguzie: JP

At Wealth Is Earned Blog, we believe that being wealthy is a choice just as being poor irrespective of the circumstance and situation and it all streams from the mindset. Throw 2 men into the same gutter, the one with the wealth mindset will make it to the top while the one with the poverty mindset would be there and groveling with other inhabitants of the gutter - it is a mindset thing. God has given you the POWER to make wealth, it is your ABILITY to APPROPRATE what God has given you that makes the difference and it is wholly and entirely dependent on you

About Dr. Jerry - the First Oguzie: JP

Dr. Jerry - the First Oguzie is a Physician, an Author, a Writer, Thinker, Founder, Convener and Success Coaching addict. He is passionate about helping people become the best versions of themselves through coaching, mentoring, teaching, enlightening and enhancing their self worth. And the Platform he uses to reach out to people is his Ministry of Encouragement (MoE). He has deep interests in Personal Development including mindset reset and habit change, Personal Finance, Wealth Creation, Health and Fitness. He believes that financial knowledge (literacy) combined with self - discipline is the key to achieving financial freedom.

He is the author of The Practical Steps To Total Financial Freedom -

Kindly engage with our Blog on the following Social Media Sites

Facebook | Instagram | Twitter | Linkedin | Youtube | Webtalk |

The post depicts how one can consciously save money and re-invest the saved monies over time. The post seeks to address frivolous expenses which when utilized adequately can translate into huge financial management and wealth creation by trimming down the odds in the expenditure list.

ReplyDeleteBy skipping coffee twice a week, you have saved $10, by skipping launch, you have saved $30 and by alternate Saturday not Sunday, you save $30. Making it a total of $70. A total income of @ $70 saved will be; $26442 annually. By 10years, we have; $264,420.

3a).1250=165.

X=65.

100 channels have been forgone. Then we will save $19.2. Therefore, per annum, we will have $6764 saved annually. 2.5% added will mean 169=6933.

6933 by 10 years will mean 69330.

This comment has been removed by the author.

ReplyDeleteMorgan Oscar

ReplyDelete1. The post is about intentionally saving very insignificant from your daily expenses with the aim of building it up to a huge source of savings, by cutting down on certain frivolities. At the end of it, we notice how much we have saved.

2.a. $5 for coffee from Monday to Friday= $25-$10 (when you skip two days)=$15.

$10 for lunch for Monday to Friday = $50-$30 (for skipping three days)= $20.

Saturdays and Sundays $60-$30 (for alternating weekly)

Total savings weekly will be: $15+$20+30=$65

2.b. Weekly savings =$65

In 52weeks (one year) = 65×52=$3,380.

In 520 weeks (ten years)=

65×520=$33,800

3% annually is returned

So 3%×3,380= $101.4 (yearly).

For ten years = $1,014

Investment at the end of ten years will be

(Yearly) $101.4+$3,380=$3481.4

In ten years, this person will earn

$1,014+$33,800=$34,814.

3.a. You get the cost of 65 channels first:

165=$1250, then for 65 = 65×$1250÷165=$492.42

Amount saved= $1250-$494.42=$757.58

3.b. $492.42 (yearly)

2.5% of 492.42=$12.31(yearly)

In ten years

%interest = $123.1

Savings= $4,924.2

Savings + %interest= $5,047.3

This comment has been removed by the author.

ReplyDelete1.The article is trying to remind us about the little things we can do that could create massive changes even when we think it does not matter but it does when compared to weeks, months or years as the case. For me personally, I think that is where we do the major expenses and run out of budget when we keep struggling with our budget and all that. I really do not know how I am happy to come around this piece of article again, in one of the books I was reading about financial intelligence named Automatic Millionaire by David Bech, he kept laying emphasis on the little minor expenses we make during the course of the day that we think it does not matter when it eats deep into our pocket. I will like to call the first one miscellaneous, avoiding some things we can easily live out and still be very fine like just eating one meat instead of 2 or 3 meat, taking one bottle instead of 4 bottles. The food aspect is something I have been thinking through though it's not as easy as being said, what if you don't have access to cooking during the lunch, that warrants that you eat outside?? For the television subscription, it's something I stopped few months ago when I moved in to my house, I now used that money to buy books and read.

ReplyDelete2a. Money spent on coffee on week days = $5 * 5days = $25

Money spent on lunch on week days = $10 * 5days = $50.

We were told $60 was spent on Saturdays and Sundays without specifying if it was spent on equal basis.

Assuming the $60 was spent on equal basis on Saturday and Sunday, thereforwe assume the $30 was spent on Saturday and the remaining $30 was spent on Sunday.

If we skip morning coffee twice a week, then the total amount saved = $25 - $10 = $15

If we also skip lunch thrice a week, then we have $50 - $30 = $20.

We are told we ate out alternate Saturday and Sunday, that means it's either we eat out on Saturday or Sunday, we can not eat out at the same time. Since we are spending $30 each for Saturday and Sunday, and we decide tomdo alternate Saturday or Sunday, then we are spending only $30 for that weekend.

Total amount of money saved = money saved during morning coffee in the week + money saved during the lunch time in the week + alternate money saved during either Saturday or Sunday

= $15 + $20 + $30

= $65

Total money saved = $65 for one week, if we want to find the amount saved for 1 year, we multiply by 52 weeks making one year

$65*52 = $3380

Amount saved in one year = $3380

2b. I = PRT/100

Where I = Interest

P = Principle

R = Rate

T = Time

For the investment after 10 years with 3% per annum, we have

A = P(1+r/n)^nt

Where A = Amount

n= Number of times interest is compounded per unit

r= interest rate(decimal)

t= time

This is for compound interest only without principle

P(1+r/n)^(nt) = A

Therefore

P= 757

r = 3/100 = 0.03

t = 10

n = 12

Therefore A =

757(1+0.03/12)^(12*10)

= Using BODMAS

Where B = bracket

O = of

D= division

M= multiplication

A= addition

S= subtraction

We solve bracket first

= 3380((1+0.03/12))^(12*10)

=3380((1+0.03/12))^(120)

=3380((12+0.03)/12))^120

=3380((12.03)/12))^120

= 3380((1.0025))^120

= 3380*1.349

= $4559.62

Total amount after 10 years = $4559.62

3a. If $1250is giving me 165 channels, then 65 channels will give me what? If less more divide

$1250 = 165

? = 65

Therefore, $1250 * 65/165

= 81250/165

= $492.42

Total amount of money saved =

$1250 - $492.42

= $757.58

3b. Therefore

A = P(1+r/n)^(nt)

Therefore we have that

757.58((1+0.025/12))^(12*10)

=757.58((1+0.025/12))^(120)

=757.58((12+0.025)/12))^120

=757.58((12.025)/12))^120

= 757.58((1.002))^120

= 757.58*1.2709

= $962.80

Total amount after 10 years = $962.80

No 1

ReplyDeleteI have come to realize in this article, that the little things we consume which we think are not cost effective. Really are; spending on tea, lunch, television without checks can make one loose money unnecessarily.

The three little daily expenses that can cuts hug hole on our finances are; Cappuccinos, going out to eat, paying for multiple television stations. However, when one check the $ spent every morning, monthly, and yearly on these, what it would be when saved for a period of 10 years. A simple compound interest arithmetic will open ones eyes, to learning how to spend wisely and save more.

No2.

Solution. Giving Monday to Friday, which amount to five(5) days; one spend $5 every morning for coffee, and spends $10 for lunch. Again, spends $60 for Saturdays and Sundays.

Now: coffee = 5*5= $25

Lunch = 10*5= $50

Saturdays and Sundays = $60

*Total money spent weekly* = *$135*

*Note*: Skipped coffee for two times in five days amount to 3x5 = $15

Skipped lunch for three times in five days amount to 2*10 = $20

Eating on alternate Saturdays and Sundays: Assuming equal expenses of $60 will amount to $30 for each day.

*Total amount skipped weekly amount to* = *$65*

a. Therefore, the amount saved equal to the total amount spent weekly minus total amount skipped weekly.

= *$135-$65* = *$70*

Amount saved for one week = *$70*

b. Given $70 invested for 10 years. With 3% annually returns.

Therefore: $70 annually amount to $70 *52 = $ 3640. (52 represent 52 weeks making one year).

Using the formula for compound interest:

A= P(1+r/n)^nt.....1

Where A = total amount

P= principal amt.

r = rate

n= no of times of interest application. (in this example interest is applied annually; n=1).

t= numbers of time periods elapsed.

Using equation 1 to solving the example given A= total amount?

P = $3640, r= 3%= 0.03, n= 1, t= 10.

Substituting the following values into equation 1

A= $3640(1+0.03/1)^1*10

A = $3640(1.03)^10

A = $3640(1.344)

A = $3640*1.344

A= $4892.16

Therefore, the total amount at the end of the investment amount to *$4893.2* approximately.

No3

a. How much I have saved would be; given yearly television bill for 165 channels = $1250. Again scaling down to 65 channels annually would be want $?. In simple Arithmetic; to get the $ in 65 channels, we use if more divide method in mathematics.

Therefore,

165 channels = $1250

65 channels = $?

Cross multiple

We have $? = $1250*65/(165).

$? = 81250/ 165

$?= *492.42*

The amount I have saved equal to totally used $ minus scaling down$.

i.e *$1250-$492.42* = *$757.58*

3a = $757.58

No3b

Using equation 1

A= P(1+r/n)^nt....1

Where P= $757.58, r= 2.5% = 0.025, n=1( note annually), t= 10 years. Substituting the above values into equation 1 we have that.

A = $757.58(1+0.025/1)^1*10

A= $757.58(1+0.025)^10

A= $757.58(1.025)^10

A= $757.58(1.28)

A= $757.58*1.28

*A = $969.7024*

Therefore the money will worth *$969.70* approximately at maturity.

#COWEC

#Nestor Amuche Alvin.

1.Today what choice of indulgence that takes a small amount from you, did you engage in. Whatever you spend on an item which is not essential has an impact on your net worth. Cutting modest spending is the popular approach to improve your money. However a closer look illustrates how purchases buid-up over time.

ReplyDeleteLatte Factor introduced by David Bach over a decade ago, remains pertinent in understanding the power of savings and compound returns. According to Bach, "The Latte Factor is built on the basis that all you need to finish Roch is to look at the mirror things you spend your money on everyday and see whether you could redirect that expenditure to yourself.

If you put aside a few dollars a day for your future rather than squandering it on small expenditures, could make a difference between generating money and living paycheck to paycheck.

Spend on your sugsrs/ Caffeine addiction, eating out and watching your favourite television to fill time, does cost us a lot of money on the long run. If we can eventually cut down on these 3 expenses, it would make a big difference to get process of wealth creation.

2. Total week spending = 5×5=25; 5×10=50; 60. Total =135

Cut down = 15+20+30 =65

Total week savings=

135 -65= 70

Savings per annum 70×52weeks =$3640

b. Approximately $4892.

Workings= P[(1+i)^n]

P= principal; i= norminal annual interest rate in percentage; n= number of compounding periods.

3. a.492.4 is the amount spent on 65 channels.

How much is saved=

1250 - 492.4= $757.6

b. $969